Note that the Tax Foundation is a 501(c)(3) educational nonprofit and cannot answer specific questions about your tax situation or assist in the tax filing process. These inflation adjustments are for tax year 2021, for which taxpayers will file tax returns in early 2022. However, with the Tax Cuts and Jobs Act of 2017, the IRS now uses the Chained Consumer Price Index (C-CPI) to adjust income thresholds, deduction amounts, and credit values accordingly.

The IRS used to use the Consumer Price Index (CPI) as a measure of inflation prior to 2018. This is done to prevent what is called “ bracket creep,” when people are pushed into higher income tax brackets or have reduced value from credits and deductions due to inflation, instead of any increase in real income.

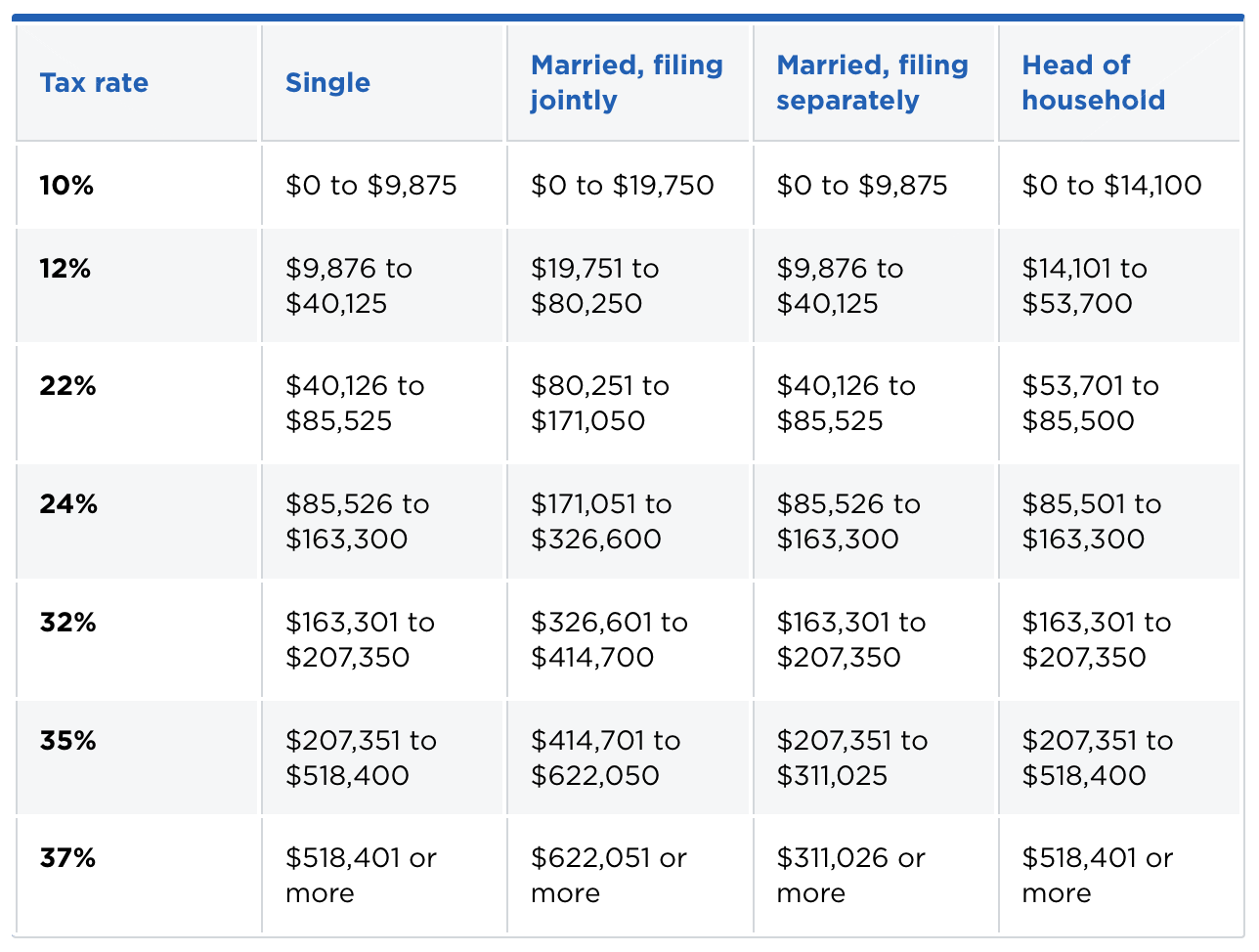

$168,993.On a yearly basis the IRS adjusts more than 40 tax provisions for inflation. 2021 Married Filing Jointly Tax brackets: INCOME It will take at least 7 weeks to know the status once the ITIN is issued IRS will send you the ITIN number through postal mail. Time required to get ITIN?Īll the required documents for ITIN can be mail to ITIN processing centre or can even submitted at the Tax payer assistance centre. Original any Identity document of any country which should have issued date and expiry date/ Certified copies of ID.Ĭondition: In order to claim a dependent on your tax returns, the dependent/dependents should have stayed in USA for more than 183 days.Documents required to get ITIN?Ī tax payer can get ITIN for his/her dependents and the process is pretty simple, below are the required documents and procedure to apply ITIN. ITIN is used for tax purposes, those who are not eligible for SSN need to apply ITIN. ITIN (Individual Tax payer Identification Number) consist of 9 digits which is issued by IRS and is must to claim dependents on tax returns, ITIN is valid up to five years there after it can be renewed. Note: According to the new tax amendment, a tax payer cannot claim personal and Dependency Exemptions. There are three tests for claiming dependents on tax returns: Married tax payers can claim spouse, kids and quailed dependents on tax return, unmarried tax payers can claim qualified dependents on tax returns, in order to claim dependents on tax returns all the dependents should have SSN/ITIN/ATIN. Resident aliens and USA citizen’s tax payers will be taxed on worldwide income Why claim dependents on tax returns? How does standard deduction works For Married Filing Jointly?Īs we learned that standard deduction reduces your taxable income, let’s go through the tax brackets below by which your taxable income is calculated for Married Filing Jointly (MFJ), in order to get qualified for standard deduction a tax payer should be eligible for any of the Green Card Test, Substantial Presence Test. Husband and Wife can file MFJ though they did not live together, but should not have been divorced.

Marriage should have been recognized by any state government.A husband and wife should have got married on any day of a tax year for which you are filing your tax returns.When married filing jointly tax return is filed both the spouses will be liable for taxes.Ī standard tax return is filed by resident aliens, non-resident aliens, green card holders and citizens, forms are 1040, 1040SR and 1040NR. Even if one spouse has income and the other does not still a husband and wife can file their filing status as MFJ. Married Filing Jointly – MFJ : Both the spouses income whether earned or unearned income can be added on Married Filing Jointly tax return, in turn a primary tax payer can claim a standard deduction amount of $25,100 on tax returns.

0 kommentar(er)

0 kommentar(er)